Gallery

Photos from events, contest for the best costume, videos from master classes.

|  |

|  |

|  |

|  |

|  |

|  |

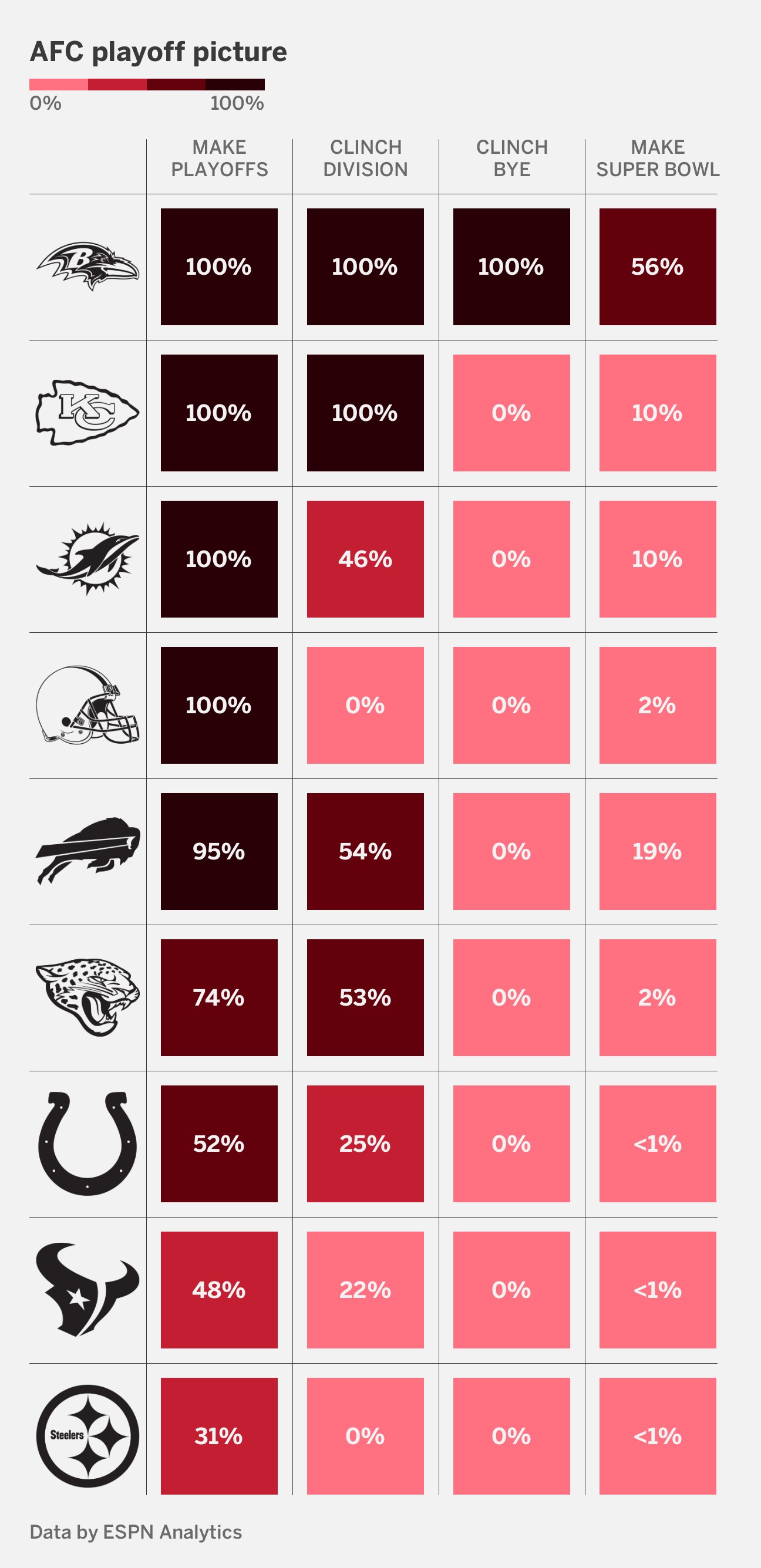

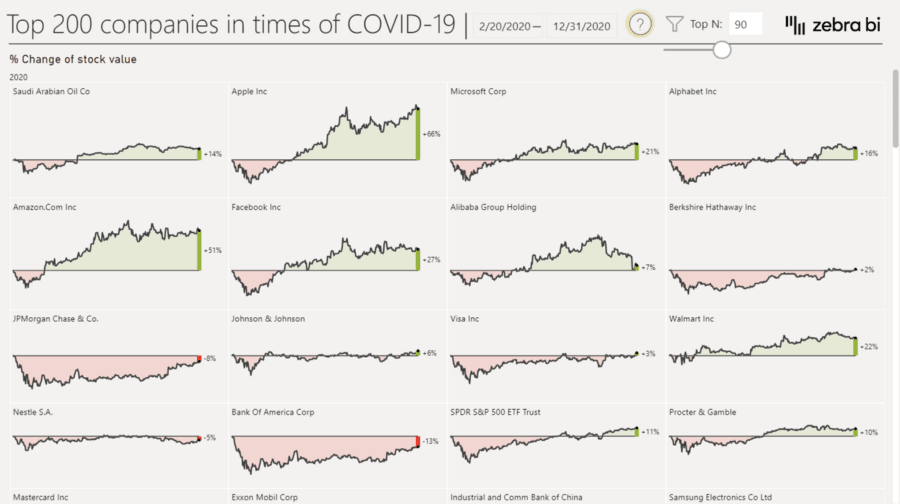

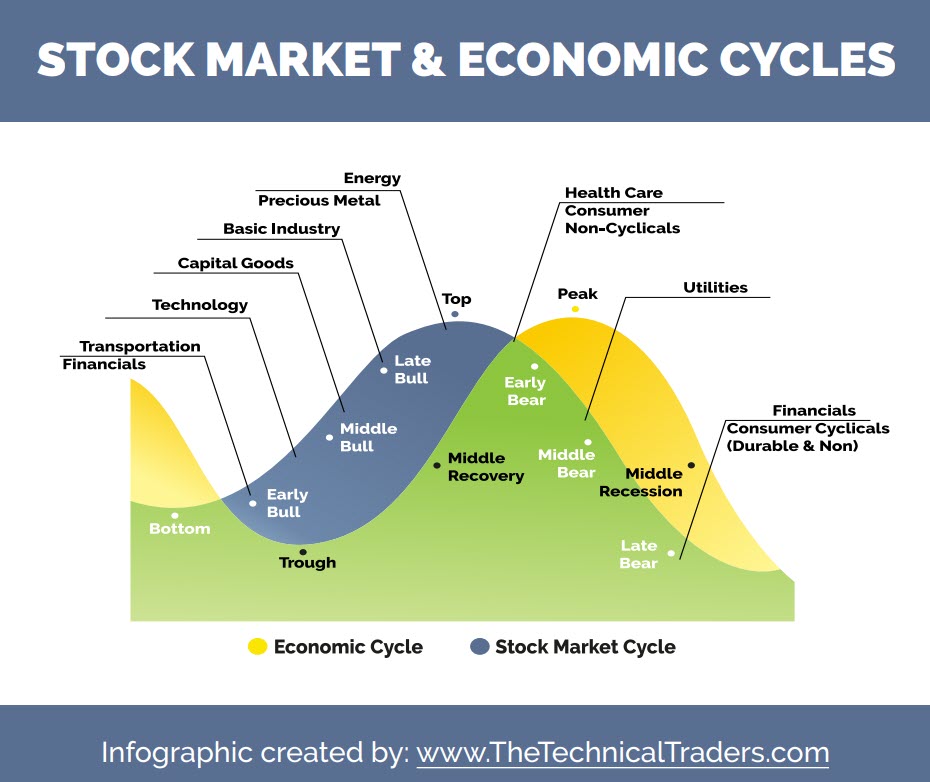

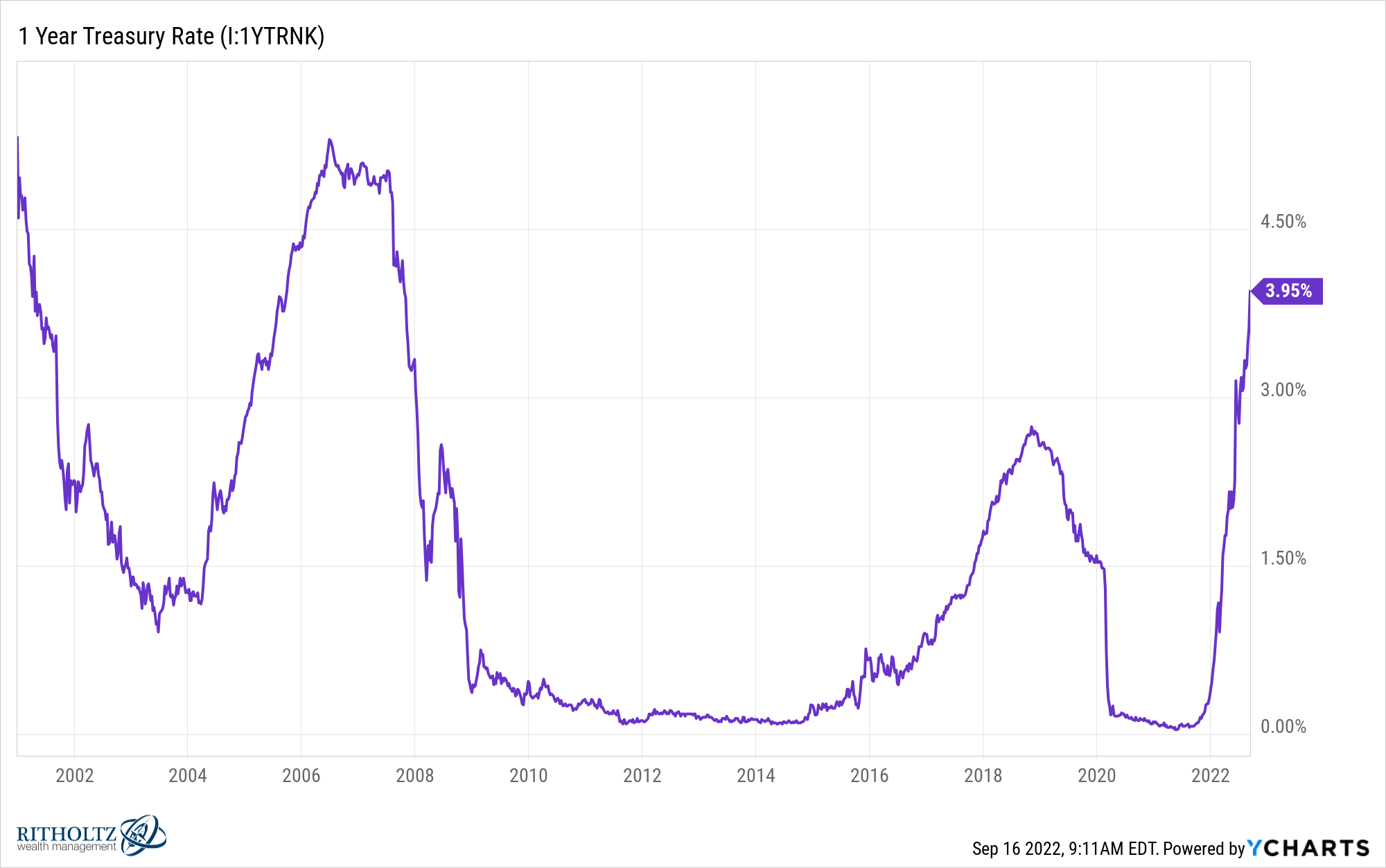

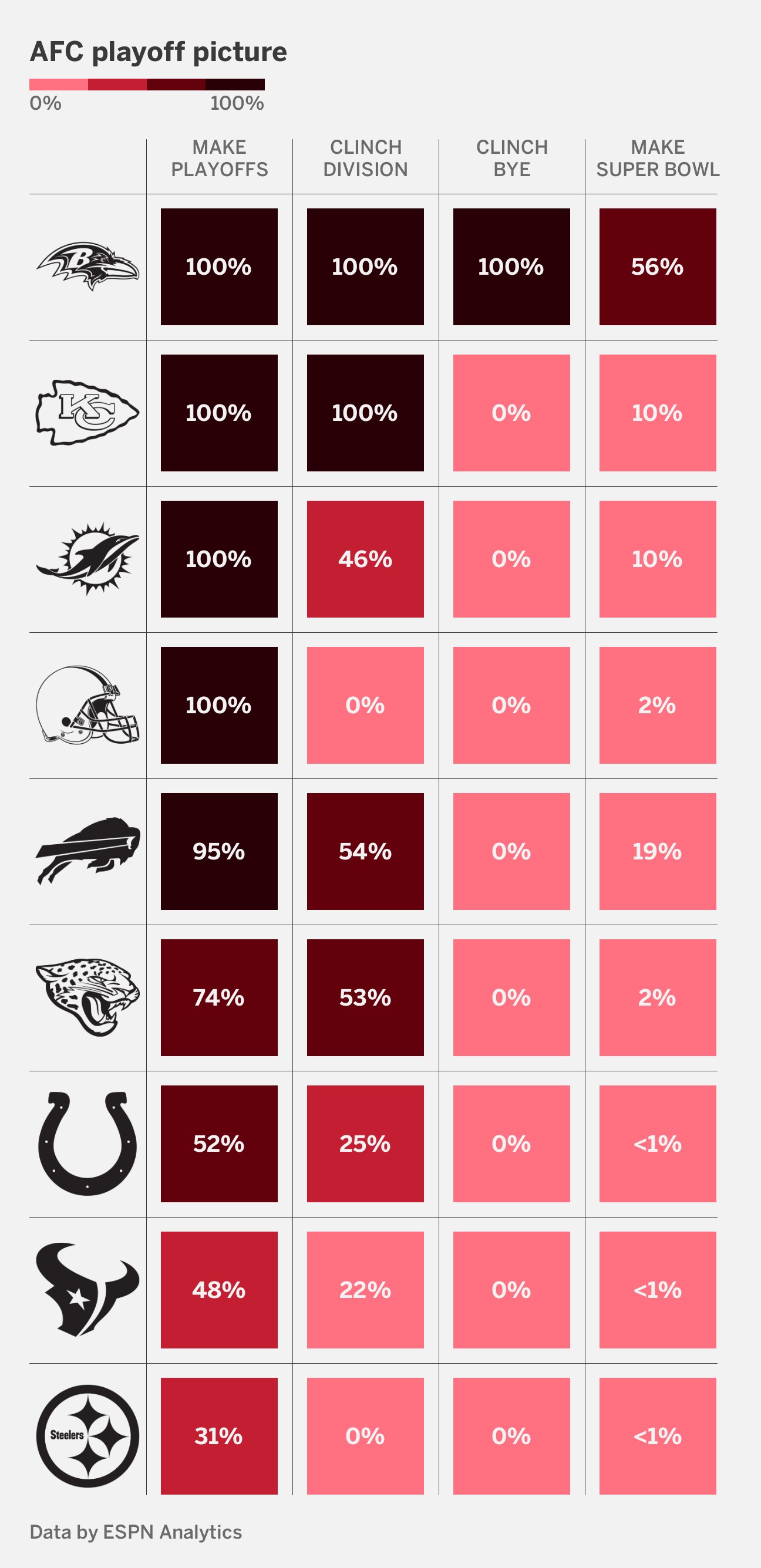

The Super Bowl indicator is a nonscientific barometer of the stock market. It was introduced by sports writer Leonard Koppett in 1978. The indicator suggests that a Super Bowl win for an AFC team The Super Bowl Indicator is a spurious correlation that says that the stock market's performance in a given year can be predicted based on the outcome of the Super Bowl of that year. It was "discovered" by Leonard Koppett in 1978 [ 1 ] when he realized that it had never been wrong, until that point. An alternate theory linking the Super Bowl to stock market performance in reverse fashion postulates that Wall Street's results can be used to predict the outcome of the game. The Super Bowl Indicator is one of the crazier market indicators that I have heard over the years. It goes something like this: the winner of the Super Bowl can predict the direction of the stock And a Super Bowl win for an AFC team hasn’t been bearish for stocks in recent years, either. The past four times an AFC team was crowned as champs — the Chiefs in 2020, the New England Patriots in 2019 and 2017, and the Denver Broncos in 2016 — the blue chip stock gauge finished the year up 7.3 percent, 22.3 percent, 25.1 percent and 13.4 If we look at its performance since 2016, it has been wrong 7 out of 8 times. The stock market and the Super Bowl winners were only in sync in 2021 when the Tampa Bay Buccaneers (NFC) won. The S&P 500 gained 14.51% that year. Furthermore, the indicator has many flaws since many teams, such as the Pittsburgh Steelers, changed conferences. The Super Bowl Indicator, a curious financial superstition, has captivated the minds of investors and sports enthusiasts alike since its introduction by Leonard Koppett in 1978. This speculative barometer suggests a correlation between the winner of the Super Bowl and the subsequent performance of the stock market. As the Super Bowl fuels spending on food, betting, and entertainment Flutter Entertainment, Wingstop and DoorDash stocks are poised to benefit The Real Super Bowl Winners: 3 Stocks Scoring Big The Super Bowl stock indicator, while a fun way to place a wager on this year’s market performance, should be used for just that — entertainment purposes only. DoorDash: Stock Rises on Strong Growth For many football fans, football Sunday isn’t complete without ordering food, and DoorDash is one of the biggest beneficiaries of this trend. It seems the result is a solid indicator (maybe not solid, but ) of stock market performance in the ensuing year. LPL Financial is out with its annual football/financial analysis and finds, “ The Super Bowl Indicator suggests stocks rise for the full year when the Super Bowl winner has come from the NFC, but when an AFC team has won The "Super Bowl indicator" of stock market performance, as measured by the Dow Jones Industrial average, goes as follows: When the winner of the Super Bowl is one of the original NFL teams, the Dow Jones Industrial average during the rest of the year goes up. That’s because they believe in the well-known “Super Bowl Indicator,” which says the U.S. stock market will rise for the year so long as the game’s winning team was never a part of the The Super Bowl “theory” links U.S. stock market performance to the results of the championship football game, held each January since 1967. Super Bowl winners and changes in the Dow Jones The Super Bowl as an investing tool? WSJ's Bill Power joins Lunch Break with Tanya Rivero and discusses how the winner of the Super Bowl has foretold the year's stock market performance for seven The predictive power of the Super Bowl "theory," which involves an apparent correlation between stock market performance and the results of the National Football League championship game, has Super Bowl Indicator and Equity Markets: Correlation Not Causation By BILL SCHMIDT AND RONNIE CLAYTON The first discussion of the Super Bowl Indicator relating equity market performance to the league (conference) of the winner of the Super Bowl was in 1978. The intention was to show that correlation does not necessarily imply causation. The S&P 500 index soared 26% in 2003, the only previous year that Tampa Bay won the Super Bowl. The stock market typically performs better when a team from the National Football League (now If we apply the original thesis of the Super Bowl Indicator, or SBI, to this year’s matchup, we can deduce that if the San Francisco 49ers win the Super Bowl, the market will finish up. If the Kansas City Chiefs win the Super Bowl, the market will finish down. But if recent results are to be believed, the opposite may now be true. You see, the Super Bowl is the focal point of one of the goofiest (and one of my favorite) signals of future stock-market performance: The Super Bowl Indicator. The Tea: The Super Bowl spurs

Articles and news, personal stories, interviews with experts.

Photos from events, contest for the best costume, videos from master classes.

|  |

|  |

|  |

|  |

|  |

|  |